Town Clerk/Tax Collector

The Town of Bradford offers residents an easy and convenient method to view and pay bills Online.

Property Taxes Review/Pay Online, Click Here

Click here to use InvoiceCloud for Vehicle Renewals, Dogs & Vitals

Credit card transactions typically take 24-72 hours to settle. An authorization is issued immediately.

We have added a Secure Dropbox in the door to our office. This will only be for Tax Payments and Registration Renewals. Please - Do Not Put Anything for Other Offices in this Box.

Jump To…

- Clerk's Office

- Tax Collector Information

- Motor Vehicle & Boat Registration Information

- Dog Licensing

- Vital Record Information

- Election Information

- Hunting/Fishing, ATV's & Snowmobiles

- Invoice Cloud Q&A

Clerk’s Office

The Town Clerk’s Office helps ensure the accurate and efficient production, issuance and retention of vital records, dog licenses, automotive registrations, boat registrations and various permits.

Contact Information

Town Clerk/Tax Collector/Notary - Erica Gross

Deputy Town Clerk/Tax Collector - Amelia Dohrn

- Address: PO Box 607, 75 West Main St, Bradford, NH 03221

- Phone: (603) 938-2288

- TC Email: tc@bradfordnh.gov

- DTC Email: deputytc@bradfordnh.gov

Hours

Tuesday: 8AM-12PM, 1PM-4PM

Wednesday: 12PM-5PM

Thursday: 10AM-7PM

Holiday Hours: Wednesday, December 24, 9am - Noon - Christmas Eve, We will be CLOSED Christmas Day and New Year’s Day.

(Town Clerk’s Office is closed the same holidays as the NH DMV)

(Back to top)Tax Collector Information

If you have an assessment question, please contact the Town Administrator at 603-938-5900

- Property Taxes Review/Pay Online, Click Here

- Please Note: There are additional fees to cover the cost of the credit card processing (2.95% with a $1.95 minimum). These fees go directly to our third party processor and are not retained by the town/city. Credit card convenience fees cannot be refunded. If your payment is returned there will be additional penalty fees.

The Tax Collector’s responsibilities are to collect all monies for property taxes, yield, excavation taxes and land use change taxes.

- What is the tax year? In the State of New Hampshire, the tax year runs from April 1st through March 31st. Assessments of your property are recorded as of April 1st of each tax year. Any new construction, addition, deck, subdivision, etc. is assessed by the town’s assessor between January and March. The first billing covers April 1st-September 30th. The second billing covers October 1st-March 31st.

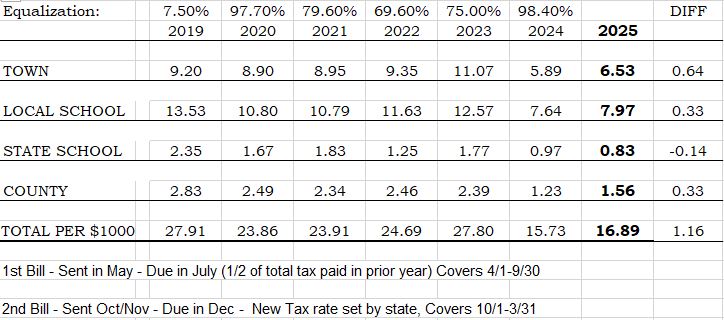

- What is the tax rate? The anticipated tax rate is established annually and is broken down by Town, School, State School, and County. The rate is then applied to every thousand-dollars worth of assessed value of the property. The tax rate is set in the fall each year.

- How often will I be billed? How are bills calculated? There are two tax bills per year. The first bill of the year (due in July) is an estimate of one half of the prior year’s full tax amount. The first bill is mailed out near the end of May. The tax rate is set in the fall of each year. The final bill is calculated using the new rate multiplied by your property’s total assessed value as of April 1st less the first bill amount. The tax bill is usually sent out late October or early November, taxes are due in December (due date is 30 days from mailing date). If your taxes are paid by your mortgage company, it is your responsibility to forward the tax bill to them, you will still get a bill from us.

- What if I don’t get a tax bill? Bills are sent, by state law, to the address of the last known owner. The assessor’s office updates ownership according to the transfers received from the Merrimack County Registry of Deeds. The deeds are sent to the assessor’s office the month following recording. The address on the deed is the address we use.

- I just bought a house, who pays the taxes?** The tax bill will be sent to whomever was listed as the owner at the time of billing. Any new owner updates will be recorded with the Tax Collectors office when the Assessor receives updates from the Merrimack County Registry of Deeds. Your attorney or closing company should check the status of taxes due on your property prior to closing, however it is your responsibility as the new owner to make sure they are paid and to advise us of your mailing address in writing. If you have questions about this, please refer to your closing statement.

- Do you have my correct mailing address? If you need to update your mailing address, please contact the tax collector’s office (603-938-2288), tc@bradfordnh.gov or the assessor’s office (603-938-5900) and provide them with your correct address.

Motor Vehicle & Boat Registration Information

The Town Clerk’s Office registers automobiles, trucks, RVs, boats, all other watercraft, trailers, motorcycles and ATVs.

PLEASE NOTE: There are additional fees to cover the cost of the credit card processing (2.95% with a $1.95 minimum). These fees go directly to our third party processor and are not retained by the town/city. Credit card convenience fees cannot be refunded. If your payment is returned there will be additional penalty fees.

New residents to the state have 60 days to register their vehicle and obtain a NH driver’s license.

Law Changes: New Hampshire will eliminate mandatory vehicle inspections starting January 1, 2026, as part of a new state budget signed into law. Most rates for registering and titling all vehicles will have an increase as of the same date.

NH DMV RATE INCREASE 1/1/2026

Specific fee increases - New driver’s license: Increases from $10 to $20. New motor vehicle registration application: Increases from $25 to 35. Vanity license plates: Increases from $40 to $60 annually. Commercial trucks: Annual registration fees will increase by 50% for trucks between 8,000 and 73,280 pounds (from $0.96 per hundred pounds to $1.44). A Senate amendment may lower the increase to $1.06 per hundred pounds.Other vehicles: Registration fees for smaller trucks, agricultural vehicles, tractors, cement mixers, and saw rigs/log splitters will also increase.

What this means for you If your vehicle registration is up for renewal on or after January 1, 2026, the new, higher state fees will apply.

Motor vehicle renewal notices for January will be mailed later than usual to account for the new fee schedule.

In-person transactions at the New Hampshire DMV are now by appointment. Schedule your next visit at dmv.nh.gov or call them at (603) 227-4000

General Information

I am a Bradford resident, what do I need to register my new vehicle?

- DEALERSHIP purchase: If you purchased a vehicle through a NH dealership you will need to bring the ( blue or white) title application. If you wish to transfer plates from your old vehicle to your new vehicle you will need to bring the current (cannot be expired) registration associated with the plates you wish to transfer. The DMV requires a certified registration to be turned in at the time of transfer. We can reprint the registration, but it will be an additional $23.00 fee. When transferring plates whoever’s name is listed first is considered the “owner” of the plates and those plates can only be transferred to a vehicle in that person’s name. If there are two people listed the plate belongs to the first person listed and cannot be transferred into the second owner’s name.

- PRIVATE SALE: If you purchase a vehicle by private sale or from an out-of-state dealership, and the vehicle is model year 2000 or newer, you must provide a title that has been signed over to you. DMV requires all 2000 and newer vehicles to be titled, this is a one-time $37.00 fee. Whoever’s name is listed on the back of the title must be present to title and register the vehicle. You will need to show ID and sign the title application. If there are two (2) buyers listed then BOTH of you will need to be present. If you wish to transfer plates from your old vehicle to your new vehicle you will need to bring the current (cannot be expired) registration associated with the plates you wish to transfer. The DMV requires a certified registration to be turned in at the time of transfer. We can reprint the registration, but it will be an additional $23.00 fee. When transferring plates whoever’s name is listed first is considered the “owner” of the plates and those plates can only be transferred to a vehicle in that person’s name. If there are two people listed the plate belongs to the first person listed and cannot be transferred into the second owner’s name. You have ten (10) days after registration to get your vehicle inspected.

- EXEMPT: If you purchase a vehicle by private sale, and the vehicle is model year 1999 or older, you must provide a bill of sale and have proof of VIN (i.e.: original old NH Registration, title or completed VIN Verification Form). If you wish to transfer plates from your old vehicle to your new vehicle you will need to bring the current (cannot be expired) registration associated with the plates you wish to transfer. The DMV requires a certified registration to be turned in at the time of transfer. We can reprint the registration, but it will be an additional $23.00 fee. When transferring plates, whoever’s name is listed first is considered the “owner” of the plates and those plates can only be transferred to a vehicle in that person’s name. If there are two people listed the plate belongs to the first person listed and cannot be transferred into the second owner’s name. You have ten (10) days after registration to get your vehicle inspected.

- If your vehicle has a GVW (gross vehicle weight) over 26,000 lbs we can only process the Town portion and you will have to go to a DMV location to finish the process. It will not be a valid registration until you complete the state portion with the DMV. AN APPOINTMENT MUST BE MADE FOR ALL TRANSACTIONS AT THE DMV - WALK-INS ARE NO LONGER AVAILABLE.

I purchased a vehicle through private sale, can I drive it without plates to get it home?

- No. You will need to acquire a 20-day plate through the State DMV or DMV Substation. Information on temporary plates can be found here: Temporary Plates

Can I just put my plates onto my new vehicle?

- No! That is not legal. You must come to the Town Clerk’s office and have a transfer done before you can put plates onto a vehicle.

I’d like to put my vehicle into my trust name, how do I do that?

- Putting a vehicle into a trust would be considered a new transaction. It would be as if you, the owner, were selling the vehicle to the trust. If it is a 2000 or newer it would require the vehicle to be retitled and reregistered. You would NOT be able transfer plates and will need to get new plates. We will need to see the trust paperwork if you do not already have anything else registered in your trust name.

I just moved to Bradford, New Hampshire, how do I register my vehicle?

- If you have a 2000 model year or newer AND the original out-of-state title in hand, you will need to bring the title, your out of state registration and proof of residency. DMV requires all 2000 and newer vehicles to be titled, this is a one time $37.00 fee. If you have a 1999 model year or older we will need to see proof to verify the VIN but are not required to title the vehicle.

- If you have a lienholder, bring all lienholder information from when the original lien was set up. We will need the address for where your title is being held, this may be different from the address you make payments. The State of NH will contact your lienholder for the title. You will also need to bring your out-of-state registration and proof of Bradford residency.

What types of plates can I get?

- Standard Passenger Plates $8.00 one-time fee

- Decal Plates $15 additional yearly cost Decal Plate Q & A

- Moose Plates $30 additional yearly cost Moose Plates Q & A

- Vanity Plates $60 additional yearly cost

- State Park Plates $85 additional yearly cost NH State Park Q & A

- Veteran’s Plates $8.00 one-time fee. Now available at the Clerk’s office

- Antique Plates $16.00 one-time fee. Now available at the Clerk’s office

Can I get Antique Plates?

- The DMV has requirements that must be met to get Antique Plates.

- Any motor vehicle, including a truck, regardless of its weight, over 25 years old, which is maintained for use in exhibitions, club activities, parades, and other functions of public interest.

Can I get a title for my Antique Vehicle?

- You must provide the original prior title or a VIN verification form (TDMV 19A), a bill of sale (if purchased within the past 12 months), and either the original prior owner’s registration or a completed Affidavit of Ownership for an Antique Vehicle (TDMV 105

- We cannot guarantee that an antique title can be produced.

- If another prior title record can be found on NMVTIS, we require that document to be surrendered in order to issue a NH title.

How do I get a replacement license plate or decal?

- Fill out the application Found HERE and either return it to the State by mail or bring it to the Bradford Town Clerk’s office. There are fees associated with replacement plates and decals.

How do I get a vanity plate?

- You need to come to the Town Clerk’s office first and then you will have to go to a DMV location to finish the process. The registration will not be valid until you complete the State portion with the DMV: Vanity Plates

How do I get a replacement registration because I lost mine?

- You can come to the Town Clerk’s office and get it replaced for a fee of $23.00.

- Motor Vehicle Title Applications- $37.00 one time charge

BOAT REGISTRATION AND ALL OTHER WATERCRAFT:

- ALL BOAT RENEWALS MUST BE ACCOMPANIED BY THE STATE RENEWAL LETTER AND SIGNED

- Boat renewals are sent from the State around January and can be mailed into the State or processed at the Town Clerk’s Office. There are additional fees when processing at the Town Clerk’s Office.

- Boats that meet the following criteria must be registered in the State of New Hampshire:

- Any boat being used in New Hampshire more than 51% of the time.

- Any Out of State resident using the boat in New Hampshire for more than 30 consecutive days. Any watercraft (rows, jet skis, etc.) that has a motor (including electric motors).

- Any sailboat that is 12ft – 20ft is required to be registered in the State of New Hampshire.

Boater Education:

- Everyone over age 16, who drives a boat with 25 horsepower or more, must complete the Department of Safety’s Boating Education Course and pass their exam.

- If you are younger than 16 and want to drive a boat you must have a passenger who has completed the Department of Safety’s Boating Education Course and is older than 18.

- For more information visit www.boat-ed.com

Dog Licensing

Please make sure your dog’s rabies is up to date. 2026 Dog Licenses will be available on January 6th, 2026 and should have be done Before April 30th. Late fees and Civil Forfeitures with a visit from the Police will start mid-June.

- The Bradford Dog Wall of Fame is here. Please email/mail in your favorite picture of your pup and we will post it on the wall in our office.

You can now renew your dog license online. If you have never licensed your dog with Bradford before you will have to come into the Town Clerk’s Office to process it.

- Pay here using InvoiceCloud

- PLEASE NOTE: There are additional fees to cover the cost of the credit card processing (2.95% with a $1.95 minimum). These fees go directly to our third party processor and are not retained by the town/city. Credit card convenience fees cannot be refunded. If your payment is returned there will be additional penalty fees.

466:1 Procuring License; Tag

- Every owner or keeper of a dog 4 months old or over shall annually, cause it to be registered, numbered, described, and licensed for one year in the office of the clerk of the city or town in which the dog is kept, and shall cause it to wear around its neck a collar to which shall be attached a metal tag with the following information thereon: the name of the city or town, year of issue of license and its registered number. The tag and license shall be furnished by the clerk at the expense of the city or town. Regardless of when the license is obtained, the license shall be effective from May 1 of each year to April 30 of the subsequent year.

466:1-a Vaccination Required.

- I. Before a license is issued under the provisions of this subdivision, the owner or keeper of a dog shall furnish to the clerk verification from a licensed veterinarian that the dog has been vaccinated against rabies in accordance with the provisions of RSA 436. Persons applying for a group license under RSA 466:6 shall also furnish to the clerk verification from a licensed veterinarian that the dogs have been vaccinated against rabies in accordance with RSA 436.

- II. Notwithstanding paragraph I, if a valid rabies certificate is on file with the clerk in accordance with RSA 436:102, the owner shall not be required to produce such verification at time of licensure.

Vital Record Information

The Town Clerk is the keeper of the vital records, such as birth, marriage, divorce and death records.

PLEASE NOTE: A LEGIBLE PHOTOCOPY OF THE APPLICANT’S GOVERNMENT ISSUED PHOTO ID MUST BE INCLUDED WITH A REQUEST MADE BY MAIL or EMAILED TO tc@bradfordnh.gov IF PROCESSED ONLINE (i.e. driver’s license, non-driver’s ID, passport).

Click here for: Online Application Request for a vital record

- Please Note: There are additional fees to cover the cost of the credit card processing (2.95% with a $1.95 minimum). These fees go directly to our third party processor and are not retained by the town/city. Credit card convenience fees cannot be refunded. If your payment is returned there will be additional penalty fees.

A Certified Copy of any Vital Record can be requested: Birth, Death, Marriage or Divorce

Please be advised that the Vital Records website charges a $15.00 fee for a search even if we can not find the record.

Marriage Licenses:

- You do not have to be a New Hampshire resident to get married in the New Hampshire. You can obtain your marriage license at ANY Town Clerk’s office. The license costs $50.00 and is valid for 90 days. Once married it is $15.00 for the marriage certificate. There is no waiting period to receive your license and no blood tests are required. Both parties must appear in person with a valid photo ID (example: Driver’s license, passport, state issued non-driver ID). Additionally, if either party has been married before, proof must be provided of the divorce/annulment or death of the former spouse. If the former marriage was dissolved by divorce, the State requires that we see the sealed final divorce decree or certified copy of the divorce certificate. If the former spouse is deceased, we will need to see a certified copy of the death certificate.

- You and your future spouse will have to complete a worksheet that will be used by the Town Clerk’s office in preparing the marriage license. You will need to know the full names of your parents, including your mother’s maiden name, as well as your parents’ state or country of birth, etc. You also need to know your Social Security number.

Please call ahead for an appointment since you will need about 30 minutes for the application process to be completed.

(Back to top)Election Information

Uniformed and Overseas Voters information in links below:

Voter Registration

Voter registration applications may be completed at the Town Clerk’s office during our regular business hours. Eligible residents are allowed to register and vote the day of the election. In-office voter registration is closed 10 days prior to an election.

Absentee Ballots:

If you need to vote by Absentee Ballot please contact the Town Clerk’s office or click the link below for a form. An Absentee ballot request form needs to be filled out before you can receive a ballot. Please note that the request form is 2 pages. You will be given a ballot for the party you are listed on the checklist. If you are undeclared you will have to choose a party if the election is party affiliated. You can then choose to return to undeclared.

- Absentee Ballot Request Form: Town Elections only – Absentee Request

- Absentee Ballot Request Form: State Elections only – Absentee Request

- Absentee Ballot - Marking & Mailing: Instructions

- Check your Absentee Ballot Status: Click Here

Linked Documents

(Back to top)Hunting, Fishing, ATV & Snowmobiles

Licenses and Permits | State of New Hampshire Fish and Game

(Back to top)Invoice Cloud Q&A

General

What is Invoice Cloud?

- Invoice Cloud is a web-based electronic invoice presentment and payment company that we have partnered with to provide faster billing and collections. Customers can pay online with more convenient billing services. New vehicle registrations and transfers must be processed in person at the Town Clerk Office. First time Dog Licenses must be processed at the Town Clerk’s Office.

Is there one account number for all of my bills?

- No, account numbers vary for the different bill types. For instance:

- Motor Vehicle – Plate #, Plate Type, Last 4 Digits of VIN

- Dog License –Owner Name, Pet Name

- Vital Record- Fill out information and email a copy of your ID to tc@bradfordnh.org

If I pay a different bill do I need to register more than once?

- Yes, one-time registration is required for each bill type to access the resident portal. You need to register for each of the bill types and accounts you wish to pay online. If you own two parcels you will need to register both parcels. If you own multiple vehicles, you will only need to register once. Once the initial registration process has been completed for each of your accounts, viewing and paying future invoices will be in place. However, if you register your accounts with the same email and password (suggested), you will get a list of accounts to choose from in your customer portal.

How does the system work?

- Customer can receive email notifications or accesses their account via the Town website by clicking on the “View or Pay Your Bill” button.

- Customers can process a One Time Payment or Register their account to schedule a payment.

- Customer will receive an email confirmation with their payment amount and payment process date.

Do I need an email address?

- Yes, an email address is required for payment confirmation. A payment receipt is sent via email.

How long will my payment history be maintained?

- 24 months is the standard retention period

Registering

Do I need to register to pay a bill?

- You may need to register to receive electronic bills by email (not offered at this time), but registration is not required for One Time Payments. One Time Payments require that you enter your payment information each time you make a payment.

Why should I register to pay a bill?

By registering, you have access to all of your invoices regardless of type and all of the features of the payment portal. These features include the ability to view all current invoices at the same time, schedule payments for a specific date, see previous invoices and payment dates, update your profile information, access the online customer service system, go paperless and sign up for Auto‐Pay. You also avoid having to enter your payment information each time you pay a bill.

How Do I register?

- Registering is easy and can be done when you make a payment. You can go directly to the Town of Bradford’s website, then to the Town Clerk’s page and click on the “Online Payments” button. You will then be directed to the next page of the Town’s website to select the line item “View/Pay Bills”. This will direct you to the website powered by Invoice Cloud. Once you select the type of bill you wish to pay and locate your account, you will be given the opportunity to register or to make a one‐time payment. If you choose to register, you will be asked to provide a password and accept the terms and conditions to use the system. The payment information you enter in your profile will then be securely encrypted and saved for your next visit.

How do I find my account number to login?

- Once you have registered, you will need only your email address and password to log in. To login the first time you use the system, you will need your account number or customer ID from your bill. The “locate your bill” screen gives instructions regarding the required information.

I forgot my password, how do I find it?

- You should click on “Forgotten Password?” at the bottom of the login screen. You will need your account number and email address to retrieve your password. If you’re unable to locate your account number, you may call the Town of Bradford (603-938-2288) and after verifying your identity, the Town can provide you with the information.

Payments

What forms of payment can I use?

- You can pay by credit or debit (processed as a credit) card or you may use an electronic check from your bank account (checking or savings). MasterCard, Discover, Visa, and American Express are accepted.

Can I still send in paper checks?

- Yes, your bill can be paid in any of the following ways:

- Web based online payment‐‐‐log in to online bill pay via the Town’s website.

- Paper check‐sent by whatever means you choose, including the US Postal Service.

- The check should be mailed to: Town of Bradford, PO BOX 607, Bradford, NH 03221

- Pay through your bank bill pay service

- In Person

What is a service or convenience fee?

- It is a nonrefundable fee added to an invoice to cover various administrative costs associated with billing and accepting payment. The non-refundable convenience fee when using credit cards is 2.95% of your transaction. The fee for using ACH is $0.95. The convenience fee is automatically calculated, and the dollar amount of the bill being paid is shown on the payment page before you submit your payment for processing. The fee is not collected by the Town of Bradford nor paid to the town. The Town of Bradford receives only your bill payment amount. The convenience fees will appear as a separate charge from the bill amount on your credit card and bank statement.

How will I know that my payment has been accepted?

- After you submit your payment, you will see a payment confirmation screen. It will contain your payment confirmation message. It will show an approved number for credit cards or a processed number for electronic check. You will also receive a confirmation email after your transaction is submitted. The email will include your account number, invoice number, amount paid, and confirmation message. If your electronic check does not pass through the bank, you will receive an email informing you of the rejected payment. You may need to call the Town in order to pay again.

How long does a credit card transaction take to process?

- Credit card transactions typically take 24-72 hours to settle. An authorization is issued immediately.

Paperless

I received and email stating “Thank you for going paperless” but I did NOT sign up!

- The paperless box is generally defaulted to enroll you in paperless billing because it helps the environment.

- Option 1: Customer must click on “Complete paperless process” link within the email to complete enrollment. If they do not, the paperless option will not be active and will drop off the system within a few days.

- Option 2: Customer can log into account and cancel the paperless registration. Choose>My Profile>Paperless Option>Cancel Paperless registration.

When I sign up to “Go Paperless” will I still receive a bill in the mail?

- No, you will receive an email notification each time a new bill is ready for you to view and pay. Email notifications go to the email address used when you registered, a second email address may added if you wish to send notifications to an additional or back-up email address.

Can I start receiving paper bills again?

- Yes, simply go into your profile and under Paperless Options, select “No, I don’t want to go paperless.” Be sure to update/save the change.

What is account linking?

- Self Service Account Linking means that payers are able to view and pay all open bills with a single transaction. When registering bills under the same email address, payers are given the option to link the related accounts within the service. Linked accounts provide the following efficiencies:

- It creates simpler payments across bill types. For example, a customer two personal property bills and six motor vehicle bills can login to any one account and view, manage preferences (Auto Pay, Paperless setting etc.) and pay all of the accounts at the same time.

- Linked accounts can access the same encrypted credit card and bank account information, so payers only need to enter it once.

- Multiple first email notifications scheduled for the same day, are grouped into one email rather than sent separately, resulting in fewer notifications for payers.

- Upon receipt of the email notification, the payer can view or pay all bills together, including any open or unpaid bills from other bill types. This is particularly useful for customers with multiple parcels and multiple motor vehicles.

- Payment receipts are always sent out individually.

- Editing an email or password changes it for all accounts in the linked group.

Security

Is my information secure?

- Invoice Cloud uses the highest standards in Internet security. Account information displayed within the customer and biller portals is truncated to protect confidential data. Any information retained is not shared with third parties.

Are my credit card and checking account numbers safe when I pay online?

- Yes. Invoice Cloud will safely store all of your financial information using Payment Card Industry (PCI) Compliant systems. This includes truncating (abbreviating) account numbers so that even the Town does not see your complete account information.

Who has access to my account?

- You and Town authorized staff. No one will have access to your financial information as all check routing numbers and credit card numbers are truncated, so you never have to worry about security. As a security precaution, we don’t even show your full financial information back to you.

Help

Who do I contact with questions about my bill?

- Bradford Town Clerk 938-2288 or tc@bradfordnh.org